Navigating the Air Force Landscape to Score Lucrative DoD Contracts

The single biggest issue companies face when trying to penetrate the U.S. Air Force marketplace is identifying who and how to work within the organization

The Department of Defense (DoD) and Air Force are gigantic. As the second youngest branch of the U.S. Armed Forces, the Air Force is one of three military departments of the Department of Defense. It alone has roughly 680,000 active duty, civilian, reserve and national guard personnel. The size of the Air Force and its hundreds of divisions and thousands of offices make it a very difficult organization to do business with. However, its $212.76 billion budget (including funds for the Space Force- the second largest service branch) means that there are several opportunities for companies who want to make the Air Force a customer…Companies just have to know how to find those customers.

The Hacking for Defense project at Stanford University works with the DoD to solve problems by shepherding new technologies into the Pentagon. Making customers out of any defense organization means navigating the complex DoD landscape. Companies unfamiliar with the process risk wasting time and money trying to break into the Defense Department’s acquisitions bureaucracy (pictured below).

The single biggest issue companies face when trying to penetrate the U.S. Air Force marketplace is identifying who and how to work within the organization. Oftentimes, companies treat the defense marketplace like the commercial marketplace believing that all they need to do is find a customer who likes their product. Finding an interested defense customer is usually not very difficult. Finding a customer that has a budget to make the purchase and the decision-making power to okay the purchase within the bureaucracy is the problem. However, there is a way. With tenacity and time, the U.S. Air Force can be a great partner.

The Hacking for Defense Initiative has mapped out the 111 organizations in the Air Force’s Innovation Ecosystem to help companies:

Identify potential partners

Create a rough roadmap for the sequence of which organizations they should be reaching out

Suggest some potential funding opportunities within the Air Force organization

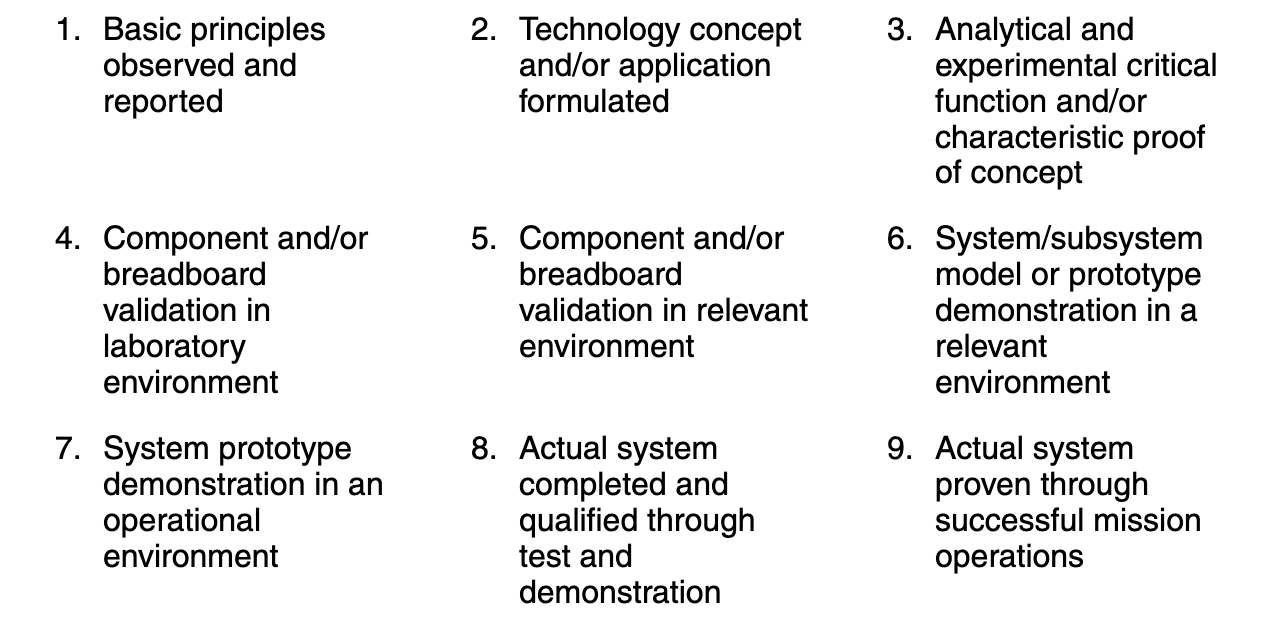

One important facet of the map, and overcoming issues in finding an Air Force customer, buyer, and decision-maker is knowing the product maturity levels each Air Force organization deals with, called technology readiness level (TRL). Each Defense organization has a sweet spot for which TRL they engage with. Some are interested in early-stage technologies. Others are interested in full blown vetted products that are manufactured at scale. The 9 specific TRLs are defined as follows:

To simplify, and align the TRL system we look at TRL as three categories: early-, mid-, and late-stage which correspond with:

TRL 1-3: Immature — Basic technology research is conducted and then applied research to create a technology concept and/or application. Proof of concept is used to determine feasibility. In the private sector, this would be the private sector with less than $1M in funding with a product-solution and metrics on company/product traction with early adopters.

TRL 4-6: Mature — Technology development/demonstration is the focus. Components first validated in a laboratory environment, then in a field environment, and then system prototype demonstrated and validated. The private sector analog would be companies with $1M-$10M of funding that have a product with a specific market fit, metrics on early adopters and traction in new markets.

TRL 7-9: Very Mature — System prototype developed and demonstrated in an operational environment. System complete and qualified, tested and proven in mission operations. Very Mature commercial products have $10M-$100M with large, scalable growth and new revenue streams to support it.

Companies aware of their technology/product’s TRL are capable of determining which organizations they should engage. The Air Force Innovation map below illustrates organizations within those 3 corresponding areas by TRL (and previous Army map).

Click the map image above to be taken to the interactive map

The map can be used by clicking on the nodes to learn about the organization and which TRL they commonly engage. TRL information enables companies to narrow down searches they conduct for Air Force opportunities on government websites like SAM.gov. In other words, rather than conducting all-of-Air Force searches, companies can filter Air Force organizations that deal with the TRL level the company possesses. Filtering saves time and increases the success rate of company engagements.

Here are a few examples of Air Force funding sources for space technologies/products based on maturity:

Early TRL

AFRL-AFOSR: Air Force Research Laboratory & Air Force Office of Scientific Research seek to accomplish their mission by investing in basic research efforts for the Air Force in relevant scientific areas. Central is the ability of AFOSR to transfer the basic research to industry, Air Force suppliers, academia and other directorates of AFRL that carry the responsibility for applied and development research leading to acquisition.

Mid TRL:

AFRL - Space Vehicles Directorate: The Air Force Research Laboratory's Space Vehicles Directorate leads the nation in space supremacy research and development. This program supports graduate students pursuing a master’s or PhD and has a fellowship program for working with the U.S. Air Force Research Lab in its Summer Faculty Fellowship Program. Previous fellowships can be viewed on the website.

Mature TRL

PEO Space Systems: the Program Executive Office is the service’s first line to acquire communication and technology tools to deliver affordable, integrated and interoperable information warfare capabilities. This organization is responsible for prototyping, procurement and fielding of C4ISR — Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance — business information technology and space systems.

Navigating the DoD is difficult. Finding the right set of Air Force customers is made even more difficult by mandates causing Air Force organizations to focus their engagements on product maturity. However, using TRL can be used by companies to filter Air Force organizations so that they engage with only those organizations that deal with the company’s level of product maturity. The Air Force Innovation Map is a reference point to help companies successfully navigate the Air Force. Aim high and persevere.

RELATED: Read Jeff Decker’s article in Andreessen Horowitz's Future on “The Iron Man Model: How Startups and the Military Can Work Together.”