Selling to Defense: Levels of the Defense Department Acquisitions Game

Part III by Jeff Decker, PhD

If you’ve read Part I and Part II of this Selling to Defense series, you know that the Department of Defense (DoD) is a complex bureaucracy akin to a video game universe that has its own language, characters and underlying logic. Entrepreneurs operating in this universe must progress through a series of levels to penetrate and scale the defense market. These entrepreneurs only advance to the next level after completing quests.

In the last post, we helped prospective players understand some of the unique facets of the DoD acquisitions universe. Now, let’s start playing the game itself – from understanding your product’s value to DoD stakeholders and developing relationships to engaging in field testing and navigating compliance. Eventually, you’ll move on to closing the deal, becoming a program of record, and facing down the next, more advanced challenge of scaling your product across the defense market.

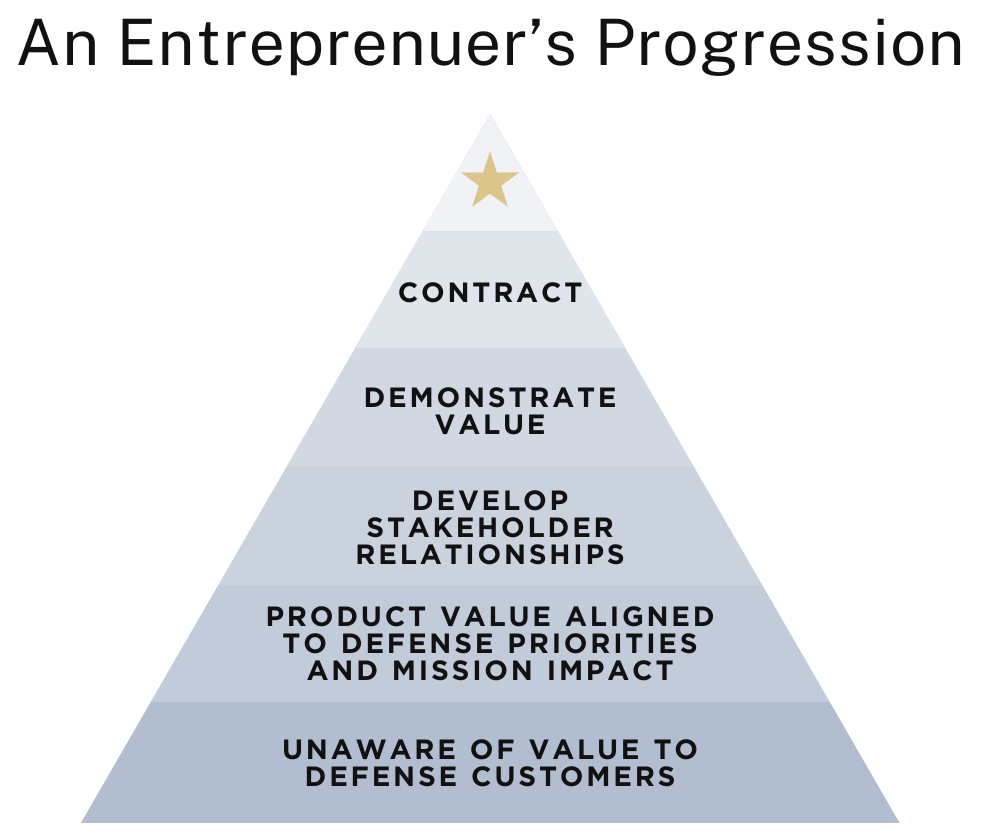

Progressing from entering the defense market to winning a contract takes time. It is more than just developing a brilliant technology and expecting people working in defense to immediately understand the value it unlocks. Rather, entrepreneurs must progress up each level of the pyramid to accomplish sales.

Each level of the pyramid has specific milestones you need to tackle before moving onto the next. The pyramid below illustrates these milestones sequentially although, in practice, you will iterate and refine your knowledge in the subsequent levels to advance to the next.

Level 1: Learn Defense Priorities to understand product impact

Identify Defense Priorities

Most entrepreneurs have a viable product to sell to the defense market but are unaware of the problems their products could solve. A common mistake entrepreneurs make when entering the defense market is focusing on the product without identifying the problem it solves or the value it creates: “You should buy our product because it is the best. It is the best because it outperforms products currently being used by the government and is better than the competition.” But decision makers and buyers in the DoD don’t buy technology just because it’s innovative–-they buy solutions that help them achieve mission priorities. So, the first “quest” is to find out which priorities and/or problems align to your product.

Reading strategic guidance like the National Security Strategy, National Defense Strategy, Science and Technology Guidance (Army, Navy, and Air Force) will give you broad insight into what the department cares about – for instance, “prioritizing the challenges posed by China in the Indo-Pacific region and Russia in Europe.” Broad insights are foundational for two reasons. First, it tells you what the DoD cares about and helps you begin to identify the specific organizations and people that are potential customers.

Although guidance is too vague to inform a product pitch it is a starting point for discovering who might be responsible for achieving these priorities and are potential customers you should begin having conversations with. As mentioned in the previous post, entrepreneurs will never sell to the DoD without getting support from three stakeholder groups: decision-makers, users, and buyers. These are the three sets of characters who drive the plot of the acquisitions “game.” To some, they feel like adversaries, but successful entrepreneurs treat them more as design partners. Carefully vetting defense priorities will point you to all three of these people so you can learn what each needs to accomplish in line with the defense priorities.

User: Users are those who will use your product daily. Users rarely make purchasing decisions but can influence the process, especially when they feel strong “pain,” or dissatisfaction with their current products. User influence must not be overlooked in your sales process. Think of users as a necessary, but not sufficient, component of defense sales.

Decision-Maker: The Decision-Maker is the person with the budget to procure your product and the authority to purchase it. Decision-Makers are directly involved in the contracting process. They are either directly signing or part of the final approval chain for any procurement decision. If they aren’t signing, they should at least be the person the signatory looks to for a "go/no-go" recommendation. Engaging Decision-Makers early is crucial to getting a Defense Department contract in a timely fashion.

Buyers: Buyers complete the transaction authorized by decision-makers. They manage the contracting/paperwork process of procuring a product so that users will be able to employ it.

All three sets of “characters” play important roles in the sales process, but decision-makers are by far the most important stakeholders. As such, they will be the focus of the rest of this article.

Second, reading these strategic documents and thinking about how your product aligns will help you develop the language for a narrative that will resonate with prospective buyers. In the DoD universe, quoting guidance documents is like saying a password. Entrepreneurs who use this language convey that they have done their homework and understand the mission. Prospective defense customers will appreciate you speaking their language and will be receptive to your discussion about how your product can help them achieve their priority missions.

Rather than reading hundreds of pages of defense guidance, use tools like AI to help. Upload the documents into Claude or ChatGPT with your product description and prompt the LLM to identify defense priorities that align with your product, making sure to request references in the output so you can take a more careful look.

Conclusion

Deciphering the government’s priorities and how your product fits or solves a problem, as well as understanding who the users, decision makers and buyers are, is a lot like finding the hidden map at the start of a game. Knowing the roadmap helps unlock the mission objective, uncovers keys to the next level, and helps navigate the realm, going around obstacles and saboteurs and helping to find a more direct path. With defense priorities in clear view and the decision-makers, users and buyers identified, you’re now equipped to progress to the next level. Stay tuned for more on Selling to Defense.

What are the first-hand behaviors, indicators, or digital breadcrumbs that show a decision-maker is already trying to solve the problem—and how can an entrepreneur validate those signals before burning time on a stakeholder who can’t or won’t move?